- By Dan Veaner

- News

Print

Print

| New York State is requiring all who receive the to re-register. Click Here to go to the online STAR Re-registration Web page. Or call 1-518-457-2036 The deadline to apply for re-registration is November 30, 2013. | ||

"Once I get a list of those people who have yet to apply from the state, they will be contacted numerous times by my office to ensure that everyone who is eligible re-registers with the state," Franklin says. "I do not want someone to miss out on this savings."

Franklins says there are approximately 19,500 eligible property taxpayers in Tompkins County. Beginning August 19th letters will be sent with information on how to re-register along with property owners' STAR code, needed for the re-registration process. Property owners who do not reapply by the November 30 deadline will lose the exemption on their 2014 School Tax bills. Losing Basic STAR will mean paying an additional $500-$600.

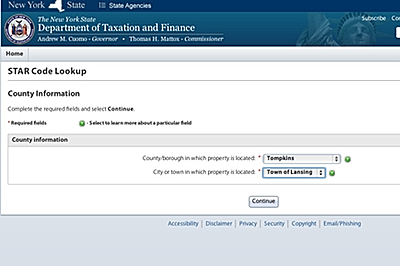

You don't need to wait for your letter to re-register for the Basic STAR exemption. The STAR Code lookup is a few simple Web form screens that are very easy to use.

You don't need to wait for your letter to re-register for the Basic STAR exemption. The STAR Code lookup is a few simple Web form screens that are very easy to use."In effect the STAR exemption provides that NYS pays for a portion of your school tax bill," he says. "For 2013 school tax bills, the Basic STAR savings will be $588 for the Lansing School District (and at most $519 for Ithaca City School, but that is not set yet)."

| Signing Up Online I decided to re-register online Wednesday morning. I was pleasantly surprised at how easy it was. The letter you will receive has your STAR Code on it, but you don't have to wait for your letter because you can use a handy lookup tool online to find your code. The tool then transfers that information into the re-registration form so you don't have to re-enter it. You are taken through a few screens in which you fill in your name and address information for each owner plus your social security numbers. In the last screen you provide contact information, and click through to a confirmation screen. The whole thing took me two minutes -- I had to look up my wife's social security number. It would have taken one minute if I had it memorized! | ||

To qualify for the Basic STAR exemption a property must be the owner’s primary residence. Only one Basic STAR exemption is allowed, so vacation homes are not eligible. In addition, the property owner’s Adjusted Gross Income (or the sum of all owner's income) must be less than $500,000.

Franklin says he is anxious to make sure that all eligible county property owners get signed up. People who don't have internet access or don't want to pay for the long distance phone call will be welcome to come to the County Assessment office for help registering, and the office has set up a call center to help by phone.

"Depending on the call numbers we get, we might be able to register someone over the phone," he says. "I can't promise to be able to handle that if there are too many calls coming into my office. We will try."

The contact information for the Tompkins County Assessment Department is: 128 East Buffalo Street Ithaca, New York 14850 http://www.tompkins-co.org/assessment/ Tel: 607-274-5517 Fax: 607-274-5507 This email address is being protected from spambots. You need JavaScript enabled to view it.

v9i31