- By New York State Comptroller's Office

- News

Print

Print

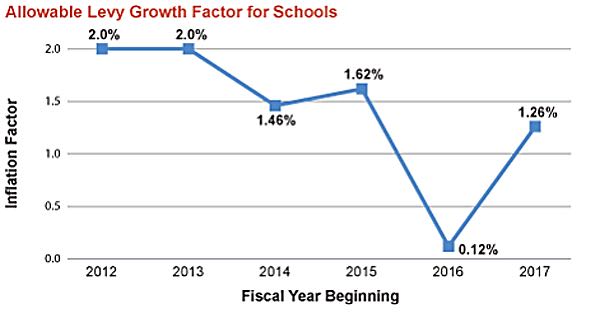

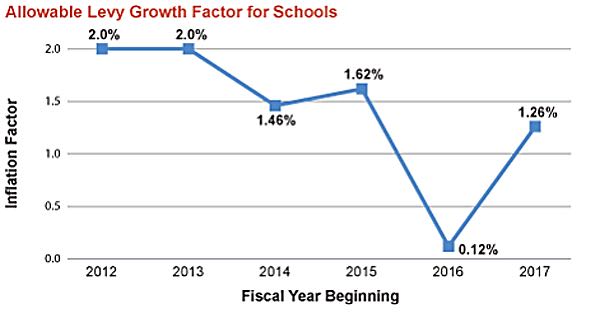

Property tax levy growth for school districts will be capped at 1.26 percent for the 2017-18 fiscal year, according to data released today by State Comptroller Thomas P. DiNapoli. The latest calculation affects the tax cap calculations for 677 school districts as well as 10 cities, including the "Big Four" cities of Buffalo, Rochester, Syracuse and Yonkers.

"For the fourth consecutive year, school and municipal officials will need to plan around a tax cap below two percent," said DiNapoli. "My audits have shown some school districts will be able to rely on ample rainy day funds to offset the low growth in revenue, but others must examine their budgets to determine where they can limit spending or cut costs in order to stay under the cap."

The tax cap, which first applied to local governments and school districts in 2012, limits tax levy increases to the lesser of the rate of inflation or 2 percent with certain exceptions, including a provision that allows school districts to override the cap with 60 percent voter approval of their budget.

Last year, school districts and the 10 cities of Amsterdam, Auburn, Buffalo, Corning, Long Beach, Rochester, Syracuse, Watertown, White Plains and Yonkers, experienced the lowest allowable tax levy growth since the law was implemented – a cap of 0.12 percent.

v13i3

"For the fourth consecutive year, school and municipal officials will need to plan around a tax cap below two percent," said DiNapoli. "My audits have shown some school districts will be able to rely on ample rainy day funds to offset the low growth in revenue, but others must examine their budgets to determine where they can limit spending or cut costs in order to stay under the cap."

The tax cap, which first applied to local governments and school districts in 2012, limits tax levy increases to the lesser of the rate of inflation or 2 percent with certain exceptions, including a provision that allows school districts to override the cap with 60 percent voter approval of their budget.

Last year, school districts and the 10 cities of Amsterdam, Auburn, Buffalo, Corning, Long Beach, Rochester, Syracuse, Watertown, White Plains and Yonkers, experienced the lowest allowable tax levy growth since the law was implemented – a cap of 0.12 percent.

v13i3